In today’s fierce business landscape, understanding and managing VAT has emerged as an integral component of every winning business strategy. Regardless of whether you are a tiny startup or a large corporation, accurate VAT calculation may dramatically impact your financial health and operational efficiency. As businesses develop and move through diverse markets, the intricacies of VAT regulations can often become overwhelming. However, mastering VAT is more than just compliance; it also presents possibilities for enhanced cash flow management and financial planning.

Employing a reliable VAT calculator can simplify the process of calculating VAT, guaranteeing that businesses remain compliant while also maximizing their financial performance. By integrating VAT considerations into the overall strategy, companies can prevent costly mistakes, enhance pricing structures, and ultimately increase their bottom line. Understanding the nuances of VAT and leveraging technology to calculate it correctly is more than an operational necessity; it's a strategic advantage that can differentiate successful businesses apart in their industries.

Understanding VAT along with The Value

Value-Added Tax, which is VAT, is a sales tax levied on the value added to products and offerings at various phase of creation or supply. For companies, correctly calculating VAT is crucial as it influences costing, cash flow, and financial performance. Every exchange involving products or offerings either incurs VAT or includes VAT in its price, making it necessary for companies to have a thorough understanding of the functioning of VAT in the respective industry.

Determining VAT correctly represents not just a compliance necessity but also a tactical element of organizational management. An incorrect calculation may result in either paying too much or paying too little, both of which can have significant monetary effects. Excessively paying VAT can strain cash flow, while paying too little can cause penalties and interest charges from government tax bodies. As a result, using tools like a VAT calculator can help with exact calculations and ensure compliance.

In addition, comprehending VAT can grant businesses with competitive advantages. Through accurately determining VAT, companies can improve the pricing model, oversee expenditures, and enhance overall financial management. This not only assists in steering clear of potential traps but also permits businesses to establish their status more efficiently within the business landscape. Mastering VAT management helps in creating financial resilience and supports success over the long term.

How to Effectively Use a VAT Calculator

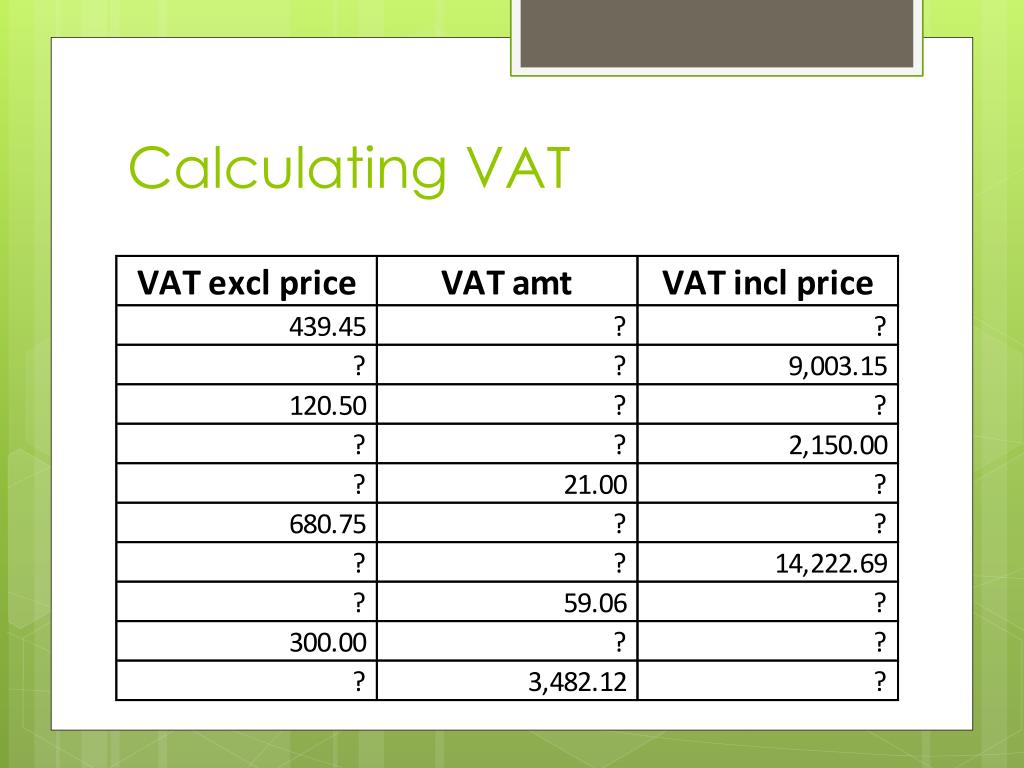

Using a VAT calculator can significantly facilitate the procedure of calculating the VAT for your business transactions . To commence, collect all relevant information including the complete price of products or offerings being traded and the applicable VAT rate . Put these values into the VAT calculator to determine the sum of VAT to charge or get back. This ensures precision and reduces time compared to manual calculations, particularly for businesses processing various transactions.

It’s essential to remain aware about the existing VAT rates relevant in your locale, as they can change . Frequently refresh the VAT calculator configurations to include these changes . This will mitigate any errors that could lead to financial penalties or incorrect reporting during tax filings . Making sure you have the accurate rates will make your VAT computations increasingly reliable and compliant with domestic regulations.

Moreover , think about embedding the VAT calculator into your comprehensive accounting software to streamline your financial workflows. A lot of accounting platforms feature built-in calculators that can instantly use the applicable VAT rates to your sales and costs. This integration minimizes the chance of inaccuracies, improves efficiency, and delivers a better overview of your VAT duties, making it a crucial tool in your operational strategy.

Common Errors in VAT Calculation

One common error companies make in VAT calculations is neglecting to consider all taxable supplies. Often, companies overlook certain goods or services that could be liable for VAT, leading to inaccuracies in their submissions. It is essential to keep detailed records and use a VAT computation tool to make sure all taxable items are accounted for, thus preventing underreporting and potential fines.

Another common mistake is misclassifying goods or services within different VAT categories. This can occur when businesses are not completely aware of the applicable rates for specific items, resulting in incorrect VAT estimates. Businesses should periodically review the VAT percentages and classifications to confirm compliance. A VAT calculator can assist streamline this task, providing precise calculations based on the right categories.

Lastly, not staying updated on legislative changes can result in significant VAT errors. calculate vat and percentages can change frequently, and companies that do not stay informed may find themselves using outdated information. Consistently checking in with tax bodies and using updated VAT computation tools can assist businesses adapt swiftly to new regulations, ensuring correct VAT filing.